Trump Tax Scandal - Images (18 results)

Totally illegal, denying the people of #NewJersey the right to vote for a candidate is over the top unConstitutional, If it hasn't occurred to the #D...

Trump Tax Scandal

BOOM! The New Jersey Senate is voting on a bill that will prevent Trump from being on the 2020 Presidential ballot unless he releases his tax returns....

Trump Tax Scandal

Leaker

Trump Tax Scandal

Client Copy

Trump Tax Scandal

Rachel Maddow responds to Stephen Colbert's take

Trump Tax Scandal

Trump Administration confirms tax information before it's posted

Trump Tax Scandal

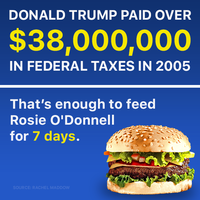

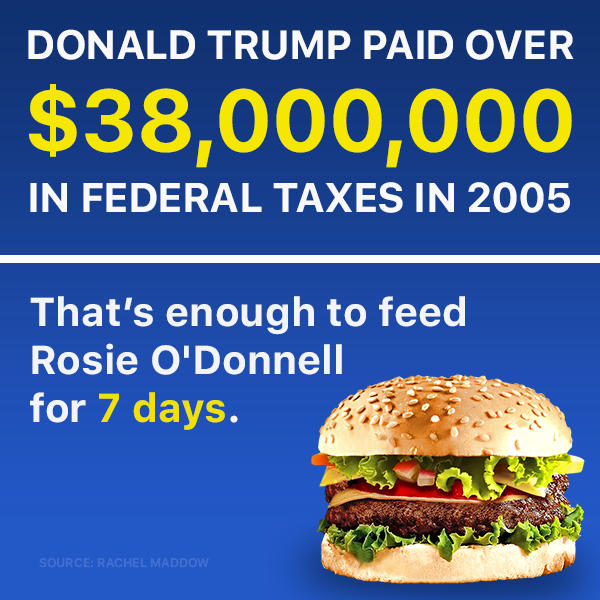

That's Enough To Feed Rosie O'Donnell for 7 Days

Trump Tax Scandal

Donald Trump Jr.'s Response

Trump Tax Scandal

Diamond and Silk React

Trump Tax Scandal

Thanks Rachel Maddow

Trump Tax Scandal

Donald Trump's Tax Returns (2005)

![FolT 40 (2005) Tax and S8 Amount from lne 37 (adjusted gross Incoms) 38 Credits 39a Check Dian da en l..] It f□You were born before January 2, 1941, t □Blind.) □Spouse was born before January 2, 1941, □Blind. J Total boxes checked ト39a If. bf your apous tamiz0 n asaparate retum a you were a dual-stslus allen, seo pago ss and enoak hers bo anine 40 ltemized deduouons (rom Schsdule A) o your viundard deduction (see let margin) r bof who41 Subtract line 40 feom line 38 os a dspandent 42 lins 38 is over $109,475, or you provided housing to a person displaced by Hurricane Katrina see page 37.Otherwise, multiply $3,200 by the total number ol exemptions claimed on line 6d 43 Taxable income. Subtract line 42 from line 41. If lino 42 ls more than line 41, enler小 | 44 Tax. Check it any taxls tram: a Form(s)af14 b. Forn 4972 45 Alternative minimum tax. Attach Form 6251 46 Add lines 44 and 4 47 48 .Ali others; aüng ce Foreign lax cradit. Attach Form 1116 il required Credit for child and dependent care expenses. Attach Farm 2441 wiéoe).49 Credit lor the slderly or the disabled. Attach Schedule R 10,000 Education credits. Altach Form 8863 hou nw51 Retirement savings contributions credi Attach Form 88 50 7,300 Child tax credit (ses page 41). Attach Form 8901 required 53 Adoption credil. Attach Form 8839 52 64 Credits from: 55 Oher credits. Chock applicable box(es): Form 8859 Form 3800 ー] Form B801 cr-Form 58 Add lines 47 through S5. These are your total credits 57 Subtract ling 56 trom line 46, lt line 56 is more than line 46, enter-0 57 Other 3 Sel-employment tax. Artach Schedule SE Taxes 59 Socal security and Medicare tax on tip income not reported to employar. Attach Form 4137 60 Addtional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 it required 61 Advanca earned income credit payments from Form(s) W-2 82 Household employment laxos. Anach Schedule H 59 Add lines $7 through 62. This is your total tax Payments 64 Federal income tax withheld from Forms W.2 and 1099 8 2005 estimated tax payments and amount applied from 2004 returm /you have -66a Earn Bd income credit (EIC). 663 chid, Nontaxable comha pay election Scftosule Elc, 67 Excess sacial security and tier 1 RRTA tax withheld (see page 69.SI 68 Additional chlld tax credit. Attach Form 88 12 69 Amount paid with request for extension to file (sce page 59) 70 Payments from: a Form 2439 bLx Form 413e s□Form a885 72 69 | 701 5 Refund tt line 71 is more man line 63, subiracl ine 63 from line 71. This is the amount you overpaid 73a Amount of lune 72 yo u want retunded to you and ill in 73b C, and 73d, Amount You Owe 74 75 Amount o! line 72 you want applied to your 2006 eatimated Amount you ows . Subtract line 71 trom line 63. For details on how to pay, soe page 60 76 Estimated tax D hird Party Do yau want to allow anothar person to discuss thls return with the IRS (sce page 81)? xJYes. Complete the folowing Designee PREPARER Personal identifeation Unda penal cs and complct per g d aacompany gae edu Ls and st on au information ot which prepvor has any knowledge. e ta u er Prpparer egelhan 4xPay4%s b巀 A ar p s RI nents, &AS lo lhe bos of rh nawiodge and bell el, they atre ea ed, Oaylime phéne numbs Joint roturn Prepar' SSN or PTIN Preparer's signature Use Only Fnao ployed ployod), adress 11 0S-0S INTEREST NOT INCLUDED * peNALTY NOT INCLUDED B8,B64 TOTAL DUE 2. 450.597.](https://i.kym-cdn.com/photos/images/masonry/001/232/645/dda.jpg)

![FolT 40 (2005) Tax and S8 Amount from lne 37 (adjusted gross Incoms) 38 Credits 39a Check Dian da en l..] It f□You were born before January 2, 1941, t □Blind.) □Spouse was born before January 2, 1941, □Blind. J Total boxes checked ト39a If. bf your apous tamiz0 n asaparate retum a you were a dual-stslus allen, seo pago ss and enoak hers bo anine 40 ltemized deduouons (rom Schsdule A) o your viundard deduction (see let margin) r bof who41 Subtract line 40 feom line 38 os a dspandent 42 lins 38 is over $109,475, or you provided housing to a person displaced by Hurricane Katrina see page 37.Otherwise, multiply $3,200 by the total number ol exemptions claimed on line 6d 43 Taxable income. Subtract line 42 from line 41. If lino 42 ls more than line 41, enler小 | 44 Tax. Check it any taxls tram: a Form(s)af14 b. Forn 4972 45 Alternative minimum tax. Attach Form 6251 46 Add lines 44 and 4 47 48 .Ali others; aüng ce Foreign lax cradit. Attach Form 1116 il required Credit for child and dependent care expenses. Attach Farm 2441 wiéoe).49 Credit lor the slderly or the disabled. Attach Schedule R 10,000 Education credits. Altach Form 8863 hou nw51 Retirement savings contributions credi Attach Form 88 50 7,300 Child tax credit (ses page 41). Attach Form 8901 required 53 Adoption credil. Attach Form 8839 52 64 Credits from: 55 Oher credits. Chock applicable box(es): Form 8859 Form 3800 ー] Form B801 cr-Form 58 Add lines 47 through S5. These are your total credits 57 Subtract ling 56 trom line 46, lt line 56 is more than line 46, enter-0 57 Other 3 Sel-employment tax. Artach Schedule SE Taxes 59 Socal security and Medicare tax on tip income not reported to employar. Attach Form 4137 60 Addtional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 it required 61 Advanca earned income credit payments from Form(s) W-2 82 Household employment laxos. Anach Schedule H 59 Add lines $7 through 62. This is your total tax Payments 64 Federal income tax withheld from Forms W.2 and 1099 8 2005 estimated tax payments and amount applied from 2004 returm /you have -66a Earn Bd income credit (EIC). 663 chid, Nontaxable comha pay election Scftosule Elc, 67 Excess sacial security and tier 1 RRTA tax withheld (see page 69.SI 68 Additional chlld tax credit. Attach Form 88 12 69 Amount paid with request for extension to file (sce page 59) 70 Payments from: a Form 2439 bLx Form 413e s□Form a885 72 69 | 701 5 Refund tt line 71 is more man line 63, subiracl ine 63 from line 71. This is the amount you overpaid 73a Amount of lune 72 yo u want retunded to you and ill in 73b C, and 73d, Amount You Owe 74 75 Amount o! line 72 you want applied to your 2006 eatimated Amount you ows . Subtract line 71 trom line 63. For details on how to pay, soe page 60 76 Estimated tax D hird Party Do yau want to allow anothar person to discuss thls return with the IRS (sce page 81)? xJYes. Complete the folowing Designee PREPARER Personal identifeation Unda penal cs and complct per g d aacompany gae edu Ls and st on au information ot which prepvor has any knowledge. e ta u er Prpparer egelhan 4xPay4%s b巀 A ar p s RI nents, &AS lo lhe bos of rh nawiodge and bell el, they atre ea ed, Oaylime phéne numbs Joint roturn Prepar' SSN or PTIN Preparer's signature Use Only Fnao ployed ployod), adress 11 0S-0S INTEREST NOT INCLUDED * peNALTY NOT INCLUDED B8,B64 TOTAL DUE 2. 450.597.](https://i.kym-cdn.com/photos/images/original/001/232/645/dda.jpg)

Trump Tax Scandal

Donald Trump's Tax Returns (2005)

Trump Tax Scandal

Rachel Maddow's Tweet

Trump Tax Scandal

Something to note

Trump Tax Scandal

#LastTimeTrumpPaidTaxes 3

Trump Tax Scandal

#LastTimeTrumpPaidTaxes 2

Trump Tax Scandal