Guides

What is the 'Inverse Cramer' Meme? Jokes About Following the Opposite of Jim Cramer's Investment Advice Explained

Jim Cramer is one of the most recognizable figures in American finance media, known for his energetic stock picks and bold predictions on CNBC's Mad Money.

Over the years, however, a growing number of investors and internet users have noticed a pattern: Cramer's recommendations during crucial market moments have not performed well.

In response, online communities developed the "Inverse Cramer" meme and slang term, a running joke and informal strategy suggesting that doing the opposite of Cramer’s advice could be more profitable.

Here’s how the meme started, why it spread, and what it looks like today.

Who Is Jim Cramer and Why Do People Distrust His Financial Advice?

Jim Cramer, host of CNBC’s Mad Money since March 2005, is infamous for dramatic, sometimes ill-fated investment advice.

During the 2008 financial crisis, Cramer advised buying Bear Stearns, just weeks before it collapsed. He also encouraged holding onto Merrill Lynch and Lehman Brothers before their infamous downfalls.

A clip of the show uploaded by YouTuber politiclips on March 17th, 2008, has over 500,000 views 17 years later.

The Wall Street Journal first reported in 2009 that betting against Cramer’s "buys" could net a 25 percent return in a month. CBS News confirmed similar findings in 2012, with a 22 percent portfolio gain in just 22 days by doing the opposite.

What Is the Inverse Cramer Meme?

The "Inverse Cramer" meme suggests that one can succeed in the stock market simply by doing the opposite of Jim Cramer’s advice.

While jokes about this date back to 2008, the phrase "Inverse Cramer" first surfaced on Twitter via @WSBConsensus on October 10, 2017, in a post about shorting NVIDIA and going long on AMD, which echoed in a popular /r/Amd thread on Reddit later that month.

Don't forget the infamous "Inverse Cramer" Short $NVDA Long $AMD #BuyNVDAPuts #BuyAMDCalls $MU $APPL $GOOGL $HMNY https://t.co/9QUvAetUTv

— WallStreetBets & Co. (@WSBConsensus) October 10, 2017

The idea found a home in online finance communities like the subreddit /r/WallStreetBets and FinTwit by 2019, where posts joking about "inversing" Cramer routinely earned hundreds to thousands of upvotes.

As Cramer’s misfires piled up, the meme matured from a casual jab into a half-serious investment philosophy.

How Did the Inverse Cramer Meme Spread?

On December 15th, 2021, Twitter user @iAnonPatriot posted a screenshot of Cramer tweeting negatively about AMC Entertainment stock. Despite Cramer’s warning, AMC’s share price rose significantly, leading @iAnonPatriot to caption it with sarcasm and highlight the inverse trend.

The next day, on December 16th, Redditor /u/jsza87 posted to /r/wallstreetbets with the title "Always inverse Jim Cramer," gathering over 8,000 upvotes since. The post featured a collage of stock tickers that all declined sharply after Cramer had recommended them.

By early March 2023, the joke had grown large enough that Redditor /u/HYPED_UP_ON_CHARTS announced, "The Inverse Jim Cramer ETF Has Officially Arrived," on /r/wallstreetbets. The post, which earned over 9,000 upvotes in the last two years, presented an ETF that allowed people to automatically short stocks recommended by Cramer.

What started as a meme has turned into an actual, tradable financial strategy.

The meme stayed relevant through new market events even into this year.

For instance, on April 5th, 2025, after Cramer warned of a coming "Black Monday" stock crash, X user @fprosk joked, "We are really testing the limits of the Reverse Jim Cramer now," gathering over 50,000 likes in just a couple of days.

Finally, the meme broke into even bigger mainstream attention when Elon Musk referenced it.

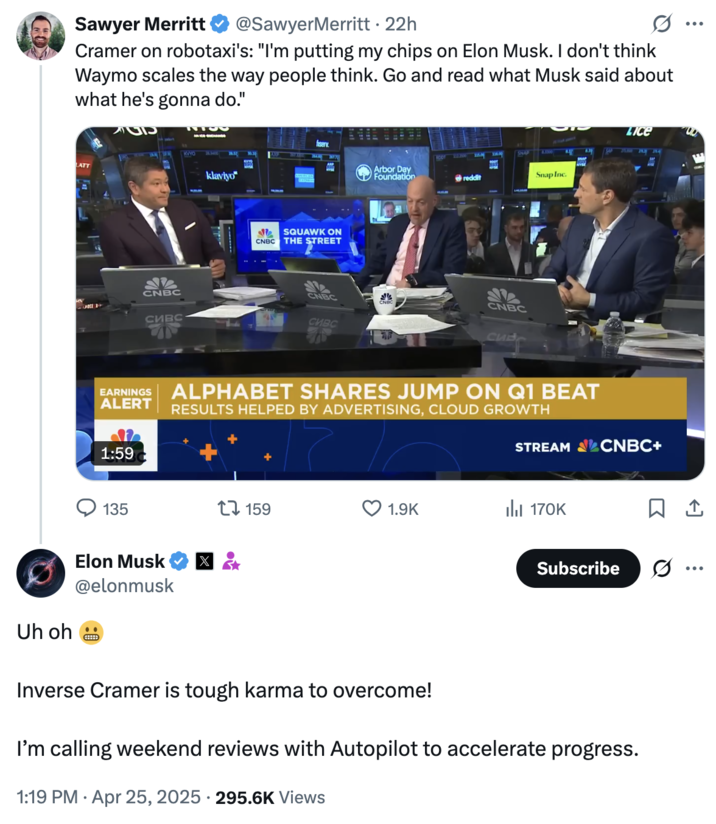

On April 25th, 2025, after Jim Cramer said during a CNBC segment, "I'm putting my chips on Elon Musk," Musk responded on X with, "Uh oh 😬 Inverse Cramer is tough karma to overcome! I’m calling weekend reviews with Autopilot to accelerate progress."

For the full history of Inverse Cramer, be sure to check out Know Your Meme's encyclopedia entry for more information.