Orange Monday / 2025 Stock Market Crash

Submission 9,384

Part of a series on Donald Trump's Reciprocal Tariffs / Trump Recession. [View Related Entries]

Related Explainer: Why Are People Calling Today 'Orange Monday'? Memes Inspired By The 2025 Stock Market Crash Explained

This submission is currently being researched & evaluated!

You can help confirm this entry by contributing facts, media, and other evidence of notability and mutation.

Overview

The 2025 Stock Market Crash, also known as the Orange Monday, refers to memes and jokes about a significant decline in numerous stock markets around the world in early April 2025. The phrase "Orange Monday," a play on U.S. President Donald Trump's association with the nickname "orange man" and the stock market term "Black Monday," began making the rounds in early April 2025 as well. The crash was influenced by several factors, including persistent inflation, increased public debt and escalating geopolitical tensions. The crash was exacerbated by Donald Trump announcing his reciprocal tariffs, including Canada, Mexico and China. The abrupt escalation in trade tensions led to widespread investor panic, resulting in substantial losses across major stock indices and amplifying fears of an impending recession. Memes about the Trump administration causing a global stock market crash began making the rounds before the markets reopened on April 7th, 2025.

Background

High Inflation, Interest Rates, and Public Debt

Inflation remained high throughout 2024, prompting the Federal Reserve and other central banks to raise interest rates to combat rising prices. By early 2025, the U.S. inflation rate stood at 4.2 percent. The U.S. federal deficit also reached $1.9 trillion in fiscal year 2025, rising to approximately 6.2 percent of the nation's GDP.

According to CNBC,[2] this escalating debt raised alarms about the sustainability of government spending and the potential for higher interest rates demanded by foreign investors purchasing U.S. bonds.[1]

Donald Trump's Reciprocal Tariffs

On April 2nd, 2025, U.S. President Donald Trump announced a comprehensive tariff regime aimed at addressing perceived trade imbalances.[3] This policy tariffs of 34 percent on imports from China, 20 percent on imports from the European Union, 25 percent on South Korea, 24 percent on Japan and 32 percent on Taiwan.

According to the BBC,[4] Trump presented the tariffs as a means to protect domestic industries and reduce the U.S. trade deficit, however, the tax was met with immediate retaliatory actions from the affected countries.

— Donald J. Trump (@realDonaldTrump) April 2, 2025

Developments

Impact on Domestic and Global Financial Markets

Following President Trump’s reciprocal tariff announcement on April 2nd, 2025, U.S. stock markets suffered historic losses. Nasdaq fell by nearly 6 percent on April 3rd, and the S&P 500 and Dow both fell over 5 percent on April 4th.[5][6] The CBOE Volatility Index also surged, signaling high investor fear.

In two days, markets lost $6.4 trillion, which some newspapers reported as more than the value of Amazon, Apple and Berkshire Hathaway combined.

On April 7th, early trading in Japan triggered the circuit breaker on futures trading after an 8.03 percent fall.[7] China's stock markets experienced significant declines.

Also on April 7th, 2025, the Shanghai Composite Index dropped 7 percent, marking its worst single-day loss in five years. The CSI 300 Index additionally fell by approximately 7 percent. In response, China's sovereign wealth fund, Central Huijin Investment, intervened by purchasing domestic equities to stabilize the market.[8]

Online Reactions

Orange Monday

Some internet users posted memes and jokes about how the stock market crash should be called "Orange Monday" instead of "Black Monday" to signify the role Donald Trump's reciprocal tariffs played in causing the situation.

For example, on April 6th, 2025, X[15] user @PaulleyTicks shared one of the earliest known posts calling for April 7th, 2025, to be called "Orange Monday," gathering over 1,000 likes in a day. Later that day, comedian Louis C.K. tweeted,[16] "It shall be called Orange Monday," gathering over 7,000 likes in a day.

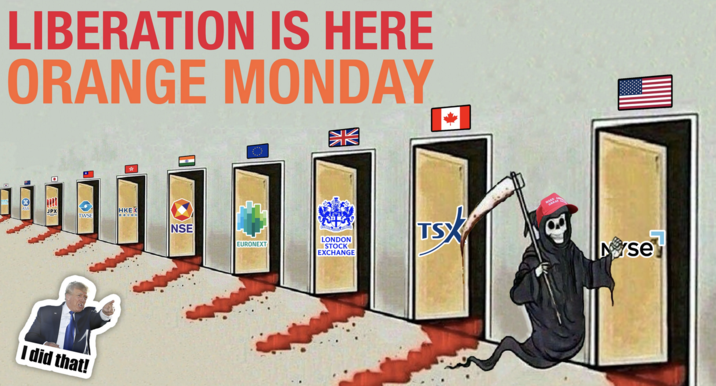

On April 7th, Redditor /u/1897235023190 posted a Death Knocking meme to the subreddit /r/neoliberal[18] that joked about "Orange Monday." The post gathered over 200 upvotes in two hours.

Also on April 7th, 2025, Barstool Sports CEO Dave Portnoy used the phrase "Orange Monday" to describe the state of the stock market, saying, "Orange Monday, Trump's tariffs have absolutely decimated the market," at the 10:38 timestamp.[17]

Davey Day Trader Presented by @krakenfx – April 7, 2025 https://t.co/xQLaexVOUz

— Dave Portnoy (@stoolpresidente) April 7, 2025

Kevin Hassett "90-Day Tariff Pause" Rumor

On April 7th, 2025, a rumor that National Economic Council director Kevin Hassett announced that Trump is considering a "90-Day Pause" on his reciprocal tariffs began making the rounds. The false quote was repeated online and by CNBC early on April 7th, causing the market to turn green briefly before dipping further.[13]

The false quote appears to be attributed to X[11] account @deitaone, also known as "Walter Bloomberg," who later deleted their post.

The account is known for reposting Bloomberg Terminal headlines. Soon after the market rose and quickly dipped in response to the false Hassett quote, @deitaone posted screenshots claiming to have sourced the news about Hassett seemingly confirming a "90-Day Pause" from a now-deleted Bloomberg headline that, in turn, cites CNBC.[12]

Later on April 7th, X[14] user @TheStalwart tweeted, "INSANE market action right now. Market exploded higher on a headline attributed to Kevin Hassett. And now nobody can figure out where it came from and the markets are diving again. An 8% surge and then a 3.5% plunge in a matter of seconds." The post gathered over 4,000 likes in a day.

Reverse Jim Cramer Posting

Some internet users posted memes and jokes about doing the opposite of whatever Jim Cramer, the host of the CNBC show Mad Money, recommends investors do, based on the long-running idea that his stock picks often perform poorly. The former hedge fund manager warned of a "Black Monday" after markets reopened on April 7th, 2025, prompting some internet users to joke that he may have "jinxed" the country out of a recession.

On April 5th, 2025, X[9] user @fprosk tweeted, "We are really testing the limits of the Reverse Jim Cramer now," in response to news that the CNBC host warned of a "Black Monday" with record-low stock prices on April 7th. The tweet gathered over 50,000 likes in two days.

On April 7th, X[10] user @wallstmemes joked, "Jim Cramer says not to panic," alongside the Chef Slowik Whispering meme, gathering over 2,000 likes in two hours.

Various Reactions

Search Interest

External References

[1] YouTube – Financial Times

[2] CNBC – Stock Market Live Updates

[3] Twitter / X – realDonaldTrump

[4] BBC – Trump Defends Tariffs

[5] CNBC – Russell 2000 Enters Bear Market

[6] Wall Street Journal – Dow Tumbles 2000 Points

[7] Straits Times – Singapore Market Sees Biggest Drop

[8] Reuters – China's Stock Market

[10] Twitter / X – wallstmemes

[13] CNBC – Trump Tariff Live Updates

[14] Twitter / X – TheStalwart

[15] Twitter / X – PaulleyTicks

[16] Twitter / X – notlouisck

[17] Twitter / X – stoolpresidente

[18] Reddit – r/neoliberal

Recent Videos

There are no videos currently available.

Recent Images 28 total

Share Pin

Related Entries 7 total

Sub-entries 1 total

Recent Images 28 total

Recent Videos 0 total

There are no recent videos.

Comments ( 67 )

Sorry, but you must activate your account to post a comment.

Please check your email for your activation code.