Crypto Crash 2022

Part of a series on Cryptocurrency. [View Related Entries]

Overview

The Crypto Crash, also identifiable by the hashtag #CryptoCrash, refers to the cryptocurrency and NFT markets struggling in early 2022 amid Bitcoin and Ethereum dropping in value rapidly over the course of one week. In mid-June 2022, the price of Ethereum specifically dropped by record numbers, causing the entire crypto market to lose an estimated $300 billion and the total value of the cryptocurrency market to fall below $1 trillion for the first time since January 2021.

History

January 2022 Crash

In January 2022, the hashtag #CryptoCrash trended for the first time on Twitter, related to both Ethereum and Bitcoin posting over 10 percent drops in value overnight. The exact cause of the price dip was never made clear but led to memes on Twitter going into the remainder of January 2022. For instance, Twitter[1] user arpit_apoorva posted a meme on January 21st, 2022, that received roughly 1,200 likes over the course of four months (shown below).

Newbies in the crypto world 🤣#cryptocrash #BitcoinCrash pic.twitter.com/Dmf0YCWodh

— Arpit Apoorva (@arpit_apoorva) January 21, 2022

May 2022 Crash

On May 11th, 2022, it was reported by Forbes[2] that "panic" was sweeping the crypto markets amid the price of Bitcoin dropping by roughly 15 percent over the course of three days. The same type of drops hit other major currencies like Ethereum, Solana and Cardano. Jaime Baeza, the chief executive of Miami-based crypto hedge fund ANB Investments, said in a statement to Forbes, "Crypto markets have been under pressure given macro events (tighter monetary policy, surging inflation, Russia’s invasion of Ukraine) and the correlation between bitcoin and global equities is high. However, the most recent fall in crypto prices is more due to the de-peg of the UST."

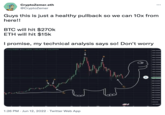

Screenshots of market price graphs were shared by Twitter[3] user sonsofissacharr on May 11th, captioning them, "Next time you hear 'cryptocurrency is highly volatile' this is what they mean," earning over 80 likes in one day (shown below).

June 2022 Ethereum and Cryptocurrency Crash

Starting on June 10th, 2022, and continuing into the following week, the price of the second-largest cryptocurrency, Ethereum, dipped under $1,100. According to Forbes,[5] the June 2022 crash wiped $300 billion from the combined crypto market, with the total value of the market falling below $1 trillion for the first time since January 2021.[12]

News outlets like Business Today[6] likened the ETH crash to Staked Ether, or stETH, which is a cryptocurrency pegged to Ether. It had been de-pegged, resulting in positions that had borrowed Ether using stETH being liquidated. Forbes additionally likened the crash to the U.S.'s rising inflation which hit "worse-than-expected numbers" on June 10th, 2022.[5]

Online discussion of the ETH crash and falling crypto value started, most notably, on June 11th, 2022. For instance, on June 11th, Twitter[7] user and CNBC financial advisor Douglas A. Boneparth tweeted, "If you invested $10,000 in Ethereum in November of last year, you would have about $3,100 today," earning roughly 17,700 likes in three days (shown below, left). Also on June 11th, Twitter[8] user NFTsAreNice posted a Drakeposting meme joking about how the price of 1 ETH was once again 1 ETH, earning roughly 4,700 likes in three days (shown below, right).

On June 12th, 2022, the Twitter[9] account DigiEconomist posted a tweet that included a graph depicting the energy consumption of Ethereum, which showed that estimated carbon emissions related to the ETH network had gone down by around 30,000 metric tons of CO2 per day in June. The tweet received roughly 4,400 likes in two days (shown below).

The online discussion related to the crash started off serious but memetic content related to it surfaced going into the remainder of June. For instance, on June 12th, 2022, Twitter[10] user CryptoZemer drew a dinosaur on the graph showing the ETH crash, earning roughly 10,400 likes in two days (shown below, left). Also on June 12th, Twitter[11] user NFTHawks posted a meme about the ETH crash that earned roughly 2,800 likes in two days (shown below, right).

Various Memes

Search Interest

External References

[1] Twitter – @arpit_apoorva

[2] Forbes – Going ‘To Zero’

[3] Twitter – @sonsofissacharr

[4] Twitter – @guy_freire

[5] Forbes – Bitcoin And Crypto Now Braced For A Surprise Fed Bombshell

[6] Business Today – What led to the Ethereum crypto crash?

[7] Twitter – @dougboneparth

[8] Twitter – @NFTsAreNice

[9] Twitter – @DigiEconomist

[10] Twitter – @CryptoZemer

[12] NDTV – Cryptocurrency Market Value Slumps Below $1 Trillion.

Recent Videos 5 total

Recent Images 38 total

Share Pin

Comments ( 114 )

Sorry, but you must activate your account to post a comment.

Please check your email for your activation code.