Overview

Silicon Valley Bank Collapse, also known as SVB Failure, refers to the rapid decline, eventual halting and shutting down of the Silicon Valley Bank (SVB), one of the largest funding sources and banks for start-ups around the world. SVB notably collapsed after a run on the bank in early March 2023 as clients began withdrawing their money following speculation it would fail, becoming the second-largest bank failure in U.S. history. The SVB collapse quickly became the subject of memes online as it started to be compared to the FTX Crypto Crash (except with traditional money vs. cryptocurrency) and thousands of people potentially losing their livelihoods as a result.

Background

On Thursday, March 9th, 2023, reports of instability at Silicon Valley Bank began to spread, with the rumors subsequently causing a bank run from start-ups who had their cash in the bank and causing the stock price to plummet by double digits almost immediately.[5] This event caused further chaos as additional start-ups would continue the trend on Friday, March 10th, when the stock price collapsed before being officially halted as news broke that California regulators had shut the bank down. CNN's[1] report on the situation uploaded to its YouTube channel, which was officially the second-largest bank failure in U.S. history, received over 375,000 views in one day as those connected to the start-up space scrambled to find answers (shown below).

Developments

FDIC Seizure and Involvement

SVB was ultimately seized by the California Department of Financial Protection and Innovation (DFPI), which then placed it under the receivership of the Federal Deposit Insurance Corporation (FDIC). However, roughly 89 percent of the bank's $172 billion in deposit liabilities notably exceeded the maximum insured by the FDIC, requiring the FDIC to receive exceptional authority from the Department of the Treasury on March 12th, 2023, stating in an announcement that depositors would have "access to all of their money starting Monday, March 13" and that "no losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer."[6]

The press release from the Department of the Treasury garnered rapid media coverage on March 12th, as well as memes and discourse on social media. For example, Twitter user KevinSvenson_ tweeted a Money Printer Go Brrr meme referencing the development, which received over 1,200 likes in roughly 18 hours (seen below).

📰 "$25,000,000,000 will be made available by the Treasury to fully protect all depositors" #FederalReserve #SVB #SBNY pic.twitter.com/JCUs24MrXt

— Kevin Svenson (@KevinSvenson_) March 12, 2023

Online Reactions

Immediately upon the news hitting of the bank being shut down by regulators on March 10th, 2023, memes began to appear mocking Silicon Valley Bank and the start-up culture in reference to the bank's involvement in that industry.

One thread of the story, which quickly became one of the most prominent topics surrounding the collapse, was that reports indicated over 90 percent of the bank's accounts and funds were not FDIC insured, meaning that roughly 90 percent of the accounts (mostly start-ups) who had their money in SVB would not be able to get compensation. Those who were insured were only able to get up to $250,000. On March 11th, Twitter user @ParikPatelCFA[2] posted a Best I Can Do Is meme as a response to this aspect of the bank collapse, receiving over 4,800 likes and 440 retweets in two days (shown below).

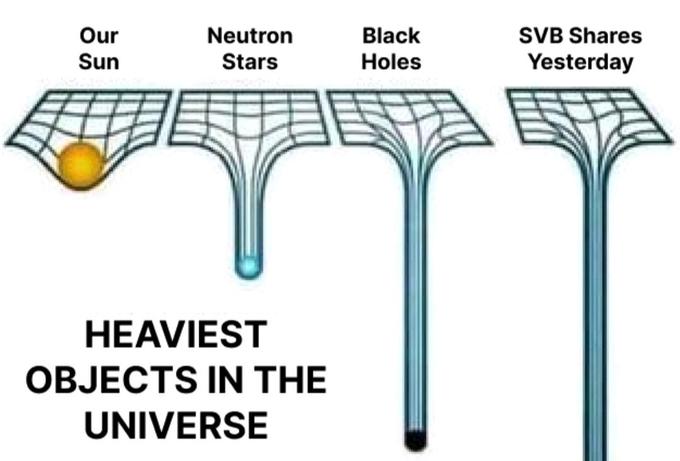

On March 11th, 2023, Twitter user @WindTrain1[3] uploaded a Heaviest Objects In The Universe meme template in which the last and heaviest object was labeled "SVB shares yesterday," a play on how far the stock sunk from over $265 per share on Wednesday to finally settling at $106 a share the following day before it was halted as the company imploded (shown below).

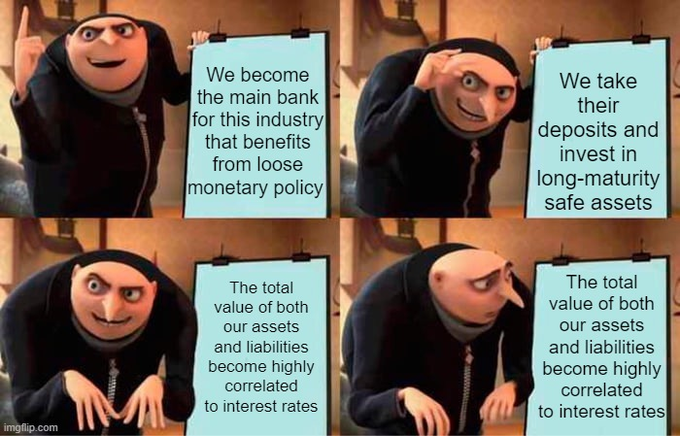

The reason for the collapse also became the subject of many memes online due to how relatively simple it was to many users. According to reports, SVB used a lot of its money to buy low-yield bonds and other assets that make money long-term, which only work out as long as interest rates stay low.[7] With interest rates in recent years being 0 percent yet increasing as the threat of inflation continued, people online were increasingly convinced that SVB was destined to fail due to this strategy not having longevity potential, as shown in the Gru's Plan meme uploaded to Twitter by user @JosephPolitano[4] on March 9th (shown below).

On TikTok, numerous videos discussing the SVB collapse also appeared on the platform. For example, on March 11th, 2023, the @morningbrew account posted a skit explaining the event under the caption "Wtf happened with Silicon Valley Bank," receiving over 158,000 likes, 15,000 shares and 1,000 comments in two days (seen below).

@morningbrew Wtf happened with Silicon Valley Bank #svb #siliconvalleybank #business #businessnews #siliconvalley #startups ♬ original sound – Morning Brew

One of the most polarizing reactions to the SVB collapse came from the investor Jason Calacanis', who went on a large caps-lock induced rant and started @ing the President of the United States and several others to try and get the Federal Government to care more about the FDIC uninsured deposits and the impending run on banks that he foresaw taking place across the country in the following days, tweeting[8] on March 10th, among other things, that the entire administration should be fired in 2024 (shown below).

Various Examples

Search Interest

External References

[2] Twitter – ParikPatel

[3] Twitter – WindTrain1

[4] Twitter – JosephPolitano

[5] New York Times – Silicon Valley Bank Fails After Run on Deposits

[6] Department of the Treasury – Joint Statement by the Department of the Treasury, Federal Reserve, and FDIC

[7] Bloomberg – SVB’s 44-Hour Collapse Was Rooted in Treasury Bets During Pandemic

Recent Videos 3 total

Recent Images 34 total

Share Pin

![Tech guys when the startup has money and when the startup money is gone fareed @it_is_fareed Tech guys when the startup has money: "Our Al will crush you under its heel. We are rendering you, teeming human biomass, irrelevant. I am become death destroyer of worlds." Tech guys when the startup money is gone: "I'm just a rural farmer, farming my code. I'm a family man" Meb Faber ✔ @MebFaber - Mar 11 Change "Silicon Valley Bank" to "Kansas Farmers Bank". Replace "tech startups" with "farmers". Replace "MBS" with "farm loans". Do you feel different? If you were calling for "let them fail" are you now screaming "save them?!" Or vice versa. Would any of the tech elite... Show more Show this thread 4:26 AM - Mar 13, 2023 634.1K Views 2,524 Retweets 15 Quote Tweets 15.8K Likes 27 +] 1](https://i.kym-cdn.com/photos/images/list/002/550/034/313.png)

![The death of Silicon Valley Bank is bad news for climate change Sophia Kianni @SophiaKianni The death of Silicon Valley Bank is bad news for climate change 1,500+ climate and energy-tech companies relied on the bank 5:36 PM - Mar 12, 2023-915K Views 388 Retweets 442 Quote Tweets 22 Sophia Kianni @SophiaKianni - Mar 12 Replying to @SophiaKianni 2,075 Likes t51 More than 60 percent of community solar financing nationwide involved the bank Silicon Valley Bank was an integral part of the early-stage climate tech community 40 135 46 ₁48.9K 117 +] ↑ 1 Sophia Kianni ✔ @SophiaKianni - Mar 12 The bank published influential annual reports on the climate-tech sector, and it sponsored events for climate VCs and startups It also provided more than half a billion dollars in revolving credit to Sunrun, the country's largest residential solar company 73 39.5K ↑ 16](https://i.kym-cdn.com/photos/images/list/002/549/751/74e.png)

Comments ( 108 )

Sorry, but you must activate your account to post a comment.

Please check your email for your activation code.